Residence Mortgages: Top Tips To Obtain You The Most Effective Offer

Article by-Whitaker BorregaardOwning a home is a huge responsibility which shouldn't be taken lightly. The first step is often to get approved for a mortgage, but there is a lot to learn before you dive right in. People who have taken mortgage in the past have contributed their knowledge to this article so you can learn how to avoid the mistakes they've made, so read on.

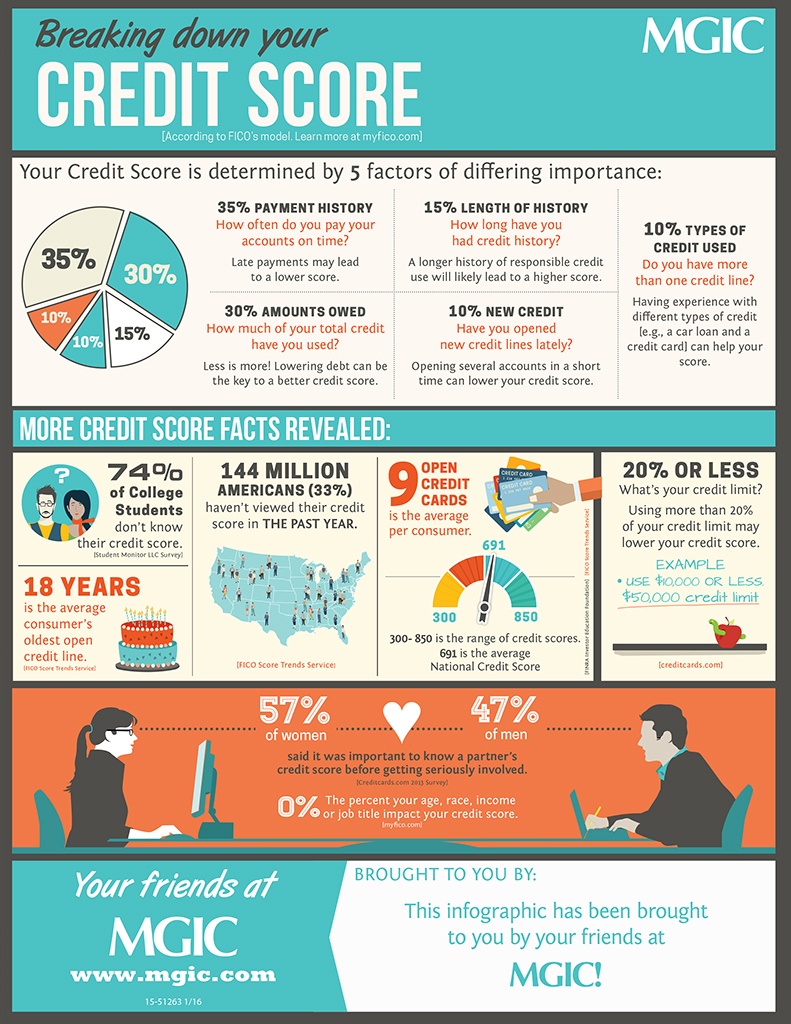

To make sure that you get the best rate on your mortgage, examine your credit rating report carefully. Lenders will make you an offer based on your credit score, so if there are any problems on your credit report, make sure to resolve them before you shop for a mortgage.

Before you apply for a brand new mortgage, determine whether or not your home as decreased in value. Even though you might think everything is great with your home, the lending institution might value it much differently, and that may hurt getting approved for the mortgage.

If you are considering quitting your job or accepting employment with a different company, delay the change until after the mortgage process has closed. https://www.forbes.com/advisor/in/banking/what-kind-of-bank-accounts-exist/ has been approved based on the information originally submitted in your application. Any alteration can force a delay in closing or may even force your lender to overturn the decision to approve your loan.

Before applying for a mortgage loan, check your credit score and credit history. Any lender you visit will do this, and by checking on your credit before applying you can see the same information they will see. You can then take the time to clean up any credit problems that might keep you from getting a loan.

Do not waste time in your home mortgage process. After you've submitted a mortgage application to the lender, this is when your clock start ticking. You have to send any necessary documents for the application process quickly. Any delays could destroy a purchase and cost you your deposit. Get an expected closing date, and then keep in touch with the lender periodically until your loan closes. Some lenders close quicker than others.

Always read the fine print before you sign a home mortgage contract. There are many things that could be hidden inside of the contract that could be less than ideal. This contract is important for your financial future so you want to be sure that you know exactly what you are signing.

Get quotes from many refinancing sources, before signing on the dotted line for a new mortgage. While rates are generally consistent, lenders are often open to negotiations, and you can get a better deal by going with one over another. Shop around and tell each of them what your best offer is, as one may top them all to get your business.

Hire an attorney to help you understand your mortgage terms. Even those with degrees in accounting can find it difficult to fully understand the terms of a mortgage loan, and just trusting someone's word on what everything means can cause you problems down the line. Get an attorney to look it over and make everything clear.

Avoid paying Lender's Mortgage Insurance (LMI), by giving 20 percent or more down payment when financing a mortgage. If you borrow more than 80 percent of your home's value, the lender will require you to obtain LMI. LMI protects the lender for any default payment on the loan. It is usually a percentage of your loan's value and can be quite expensive.

Don't use real estate brokers or mortgage lenders who encourage you to lie on your home mortgage application. It is illegal to lie on this application, and it is a legal document. Misrepresenting your income or other information is grounds for criminal prosecution. Working with people who encourage you do commit a crime is not a good idea.

While try this web-site are in the process of getting a mortgage loan, do not apply for any new credit cards. Every time your credit is checked it puts a mark on your credit score. Too many of these will make it difficult on you if your credit is already a bit questionable.

Shop around for mortgage refinancing once in a while. Even if you get a great deal to start with, you don't want to set it and forget it for several decades. Revisit the mortgage market every few years and see if a refinance could save you money based on updated insurance rates.

Don't use real estate brokers or mortgage lenders who encourage you to lie on your home mortgage application. It is illegal to lie on this application, and it is a legal document. Misrepresenting your income or other information is grounds for criminal prosecution. Working with people who encourage you do commit a crime is not a good idea.

Go online and use a mortgage calculator to find out how much of a loan you can afford. There are many sites that offer these free calculators. Additionally, there are calculators that will tell you the final price you will be paying at the end of the loan and others that show how much you can save by paying extra toward the principal.

While you want to focus on the rate that you get with a home loan, there are other things to focus on as well. Many other fees and expenses can vary from one lender to the next. Take points, closing costs and other loan terms into consideration. Get quotes from different lenders and then make your decision.

Before you apply for a home mortgage, be sure to check your credit score. You can get a copy of your credit report for free once a year from one of the three big credit reporting companies. Check to be sure your credit report is accurate. Correct any problems you find. It is very important to have a clean and positive credit report before applying for a home mortgage.

Get your credit under control. If you currently have a wallet full of plastic for every occasion, you should downsize. Having too much available credit can harm your loan, even if it is not debt. Close any non-essential accounts. Chose a gas card, a store card, and a single credit card to keep.

Now that you've made it to the bottom, there is only one thing left to do. Make use of this learning you have done today by seeking out an exceptional mortgage. It will be an easy process, now that you know so much, so get started as soon as possible.